louis vuitton vat refund italy Use our Italy VAT refund calculator to estimate your savings on designer bags, shoes, or souvenirs, as you’ll be paying VAT (Value-Added Tax) on your purchases. Did you know you can get a refund on some of that tax . Netcracker darba sludinājumi. Pašlaik uzņēmumam Netcracker nav darba sludinājumu. Jūs varat izveidot paziņojumu, un mēs paziņosim, kad šāda pozīcija būs pieejama. Vakances e-pastā. Skatīt visus darba sludinājumus. CV-Online ir vieta, kur meklēt un atrast labākās darba un karjeras iespējas visās Baltijas valstīs - Latvijā, Lietuvā un Igaunijā.

0 · vat refund italy 2022

1 · vat on shopping in italy

2 · stores with no vat refund

3 · shopping in italy vat refund

4 · italy vat refund

5 · italian vat refund calculator

6 · how much is vat refunded

7 · high end stores with vat refund

Daikin LV Series 12,000 BTU 23 SEER Single Zone Ductless Mini-Split Heat Pump System - Wall Mounted. Skip to the end of the images gallery. Skip to the beginning of the images gallery. By. Daikin. Model. RXS12LVJU / FTXS12LVJU. ID. 10816. Rating: (1) In Stock - Ready to Ship. $1,749.00. As low as $56.43/mo* Free Shipping. Mini-Split Install Kit.

In this article, you’ll learn how to offset your holiday expenses by reclaiming VAT upon exit from Italy. So before you board your flight to Milan, home of fashion, fine wine, and the famous dessert called Panettone, take . Use our Italy VAT refund calculator to estimate your savings on designer bags, shoes, or souvenirs, as you’ll be paying VAT (Value-Added Tax) on your purchases. Did you know you can get a refund on some of that tax .

Has anyone purchased anything recently in Italy to go back to North America and what was the process to get your refund? Was it at the airport? One website said you're not supposed use . But what country offers the absolute best tax-refund for Louis Vuitton bags? We’re going to help make it easy for you with our handy table, which provides all information on VAT percentage amounts for several .VAT refunds are not given in stores. The exception to this rule is airport purchases for foreign travelers, which give you a full 22% VAT refund onsite. You can either go to a local kiosk or wait to do it at the airport. Many U.S. travelers are unaware that they can claim a VAT refund on certain items purchased in the E.U. and more than 160 countries. Here’s how to do it.

Global Blue is one of the big vendors who facilitate this. Once you get the forms submitted you get the refund back to your credit card or in cash. Each country has an amount you need to spend in a store to qualify for the tax back. For . Louis Vuitton Italy Shopping Guide And The VAT Refund. ****** Plus, in Italy, as a non-EU traveler, you can claim a portion of the VAT back, a significant perk when luxury shopping. Typically, you can expect . In Italy, the standard VAT rate is 22%. After deducting the administrative fee and the fee of the tax refund company, you’ll expect to receive an 11%-15.5% refund rate of your purchase amount, depending on how much .

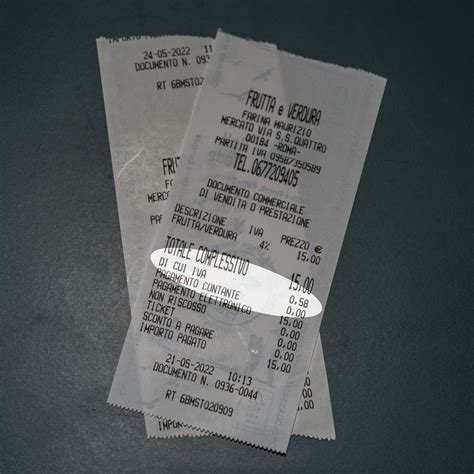

It's important to note that VAT tax is included in the sticker price of all items in the EU, and that the VAT refund is depended on how much you spend in each store and what types of products you buy. Breakdown of my purchases below, with .What is the Return & Exchange Policy? Merchandise in perfect saleable condition with original receipt may be exchanged or returned for a full refund within thirty (30) days from the original purchase date except for high watches, high jewelry, and personalized or made-to-order items (including hot stamped or engraved products), which are final sale only.Can I claim a VAT refund for my item purchased online & delivered in store? Click & Collect orders are purchased online or over the phone. This service is only available for clients with a valid billing address within the 9 European coutries covered by this website and a matching credit card nationality.

vat refund italy 2022

Take Louis Vuitton Onthego GM in Monogram Reverse Canvas. It's ,250 in the US. With tax, it'll turn to be at least ,412. In Europe, the same purse is 2 400€ (approximately ,400 in USD). With a VAT refund, the price declines even further, totaling at ,280. VAT refund in Italy. In Italy, the standard VAT rate is 22%.After deducting the administrative fee and the fee of the tax refund company, you’ll expect to receive an 11%-15.5% refund rate of your purchase amount, depending on how much you spent. And Italy also has one of the highest minimum spending requirements (€154.95).To get a tax refund, you’ll need to .

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc. . How to get a tax refund at Louis Vuitton, Chanel, Dior, Céline, and .

Navigating the VAT system is a key step in claiming your tax refund in Italy. VAT, a consumption tax added to most goods and services in Italy, varies by product category. . If I buy from Louis Vuitton at the airport is the tax refund closer to 22%? Reply. Nicolò Bolla. June 2, 2023 at 3:40 pm. Yes it is. Reply. Yair.

Beware that if you want a VAT refund in cash, the refund is limited to €1000 for each store you purchased from. I made 2 separate purchases from Chanel. For one purchase, I was refunded €600 in cash at the airport.

The differences lie in how much you are able to claim back for VAT or tax refund as a tourist. Refund companies, such as Diva, Global Blue or Planet Tax Free, will usually charge a substantial commission to process your refund claim and the company you engaged will have different amount of actual VAT refund. Louis Vuitton in Italy is less expensive than it is in the UK – the emphasis here is on ‘slight’ because the price difference may be as small as less in Italy than in the UK. This small difference in price is largely attributed to the fact that the UK’s Sterling Pound is a very different currency compared to the Euro that is used . 1. VAT Refund. The main reason, however, to buy your next Louis Vuitton piece in Paris is because of the VAT tax refund, i.e. the sales tax refund! All European countries have a system in which you spend over a certain amount of money, you receive a VAT refund which varies by county; in France, the VAT refund rate is 12% of the purchase price.

In 2024, Europe consistently remains the cheapest region that sells Louis Vuitton bags, making it a favored destination for luxury handbag enthusiasts. The most inexpensive country for these iconic bags in the European Union, are relatively comparable across different eu countries but vary in terms of tax or VAT refunds available to tourists.There are 3 main reasons that Louis Vuitton is cheaper in Paris, the first reason is the VAT Tax Refund that is available in EU countries including Paris, France. If you spend more than 100.01 Euros at Louis Vuitton you qualify for the VAT Tax refund in Paris, which is a saving of an additional 12% which is applied to your credit card 30–90 days after leaving the EU. 1. Does Louis Vuitton offer VAT refund? 2. Can you claim VAT in Louis Vuitton? 3. How do I get my Louis Vuitton tax free? 4. How much is the VAT refund in Paris LV? 5. Is Louis Vuitton tax free in Paris? 6. How much is VAT in France Louis Vuitton? 7. How do I get VAT refund? 8. What country is cheapest to buy Louis Vuitton? 9.

The majority of fashionistas will opt to buy their Louis Vuitton handbags in the United Kingdom or Europe, as most of the countries offer wonderful VAT refunds. Always remember that buying from a tax-free country . Another reason Louis Vuitton is cheaper for Americans to buy overseas in countries like Italy is because of the VAT refund. This is a refund non-European Union citizens receive back on purchasing luxury goods .There are several VAT refund companies at the airport, but from what I can tell, since LV works with Global Blue, you need to go to their desk. The companies keep a small percent of the refund, so we thought maybe we could “shop around” but this wasn’t the case.

Answer 1 of 15: Is there a Louis Vuitton store in Italy? And if so, are the prices different than in America? Rome. Rome Tourism Rome Hotels Rome Bed and Breakfast Rome Vacation Rentals . My experience has been that Italian designer brands are cheaper in Italy, in addition you get a 12% refund of the VAT. Gucci, Fendi, Prada , Dior, LV .LOUIS VUITTON Official Europe site - Locate all Louis Vuitton Stores in Italy and in the World. Find more about our exclusive store network : addresses, services, product offers and opening hours. . Via Dell’Aeroporto di Fiumicino, 320 - Aeroporto Leonardo da Vinci - Avancorpo del Terminal 3, 00050, Roma, Italy +39 02 00 660 88 88 Louis . So more VAT doesn’t mean more cash back. It depends on the tax regulation of the country and the fees of the refund service companies.The amount of VAT refund depends on the country you’ve bought the goods. So for example, you’ve bought a Chanel bag in Germany, a Louis Vuitton bag in the Netherlands and a Gucci Bag in Italy.

This article is about how much VAT refund you can get in Europe.Europe is an amazing place to shop for designer bags.Think about it; Italy is famous for their impeccable leather craftsmanship and give rise to world-class brands like Prada, Tods, Dolce & Gabbana, Valentino and Marni. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Louis Vuitton Stores Fill out the Paperwork. If purchasing in a Louis Vuitton store, they’ll fill out the VAT refund paperwork and have you sign it in the correct spots right there in-store at the time of purchase.

For example, France and England have a VAT rate of 20%, while Italy’s VAT rate is 22%. If you want to know the VAT rate of a specific country, you can easily find a list online. . Louis Vuitton: O Case: 420 euros, VAT refund: 70 euros Total savings: 9.04; Louis Vuitton: Passport holder: 225 euros, VAT refund: 37.50 euros Total savings . Is Louis Vuitton cheaper in Vegas? When talking about where are Louis Vuitton handbags the cheapest, Las Vegas never crosses our minds. The local sales tax here is one of the largest – 8.38%. Yes, Las Vegas is for spending money, not for saving them. Best Place to Buy Louis Vuitton Online. 1. 24s.com

The international luxury and Louis Vuitton stores sell their bags much affordably thanks to the favorable taxes, the VAT tax refunds, and also the fact that Louis Vuitton’s bags are made in the European markets where the bags are generally cheaper because they are not subjected to the high taxes or other costs that add up to the final price .

vat on shopping in italy

For example, if we look at Louis Vuitton’s Pochette Metis, the price is currently €2,050 (,250) in France, £1,830 in the UK (,235), and ,570 (+tax) in the US. 2. VAT Refunds. The second reason why prices are usually lower in the EU and France is the VAT tax refund system that is established in countries of the European Union.

You need to fill out a VAT refund form at the store when purchasing. It’s like filling out a raffle ticket, but here, everyone’s a winner! After getting your VAT refund amount at the airport, your Louis Vuitton handbag purchase might just turn out to be a great deal!

hermes italy official website

adidas sneakers dames blauw

rolex 136660

stores with no vat refund

Functional design and impeccable craftsmanship blend seamlessly in the Daily Multi Pocket 30mm Belt. Inspired by the utility trend, this striking piece features removable pouches plus a key holder for maximum practicality.

louis vuitton vat refund italy|vat refund italy 2022